Hourly to salary calculator with overtime

To keep the calculations simple overtime rates are based on a normal week of 375 hours. There are groups such as tipped workers some high school and college students and.

Tom S Tutorials For Excel Calculating Salary Overtime Tom Urtis

Ad Easy To Run Payroll Get Set Up Running in Minutes.

. 8000 6000 14000. So the New Jersey minimum hourly wage is 1300. 1200 40 hours 30 regular rate of pay.

Monthly Overtime If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10 15. Taxes Paid Filed - 100 Guarantee. Overtime can be entered separately.

And as Florida follows the federal time and a half policy for overtime any hours over 40 in a week the overtime rate will increase from 15 to 1650 as well. As said before not every New Jersey worker is entitled to the states hourly minimum wage. For instance if the hourly rate is.

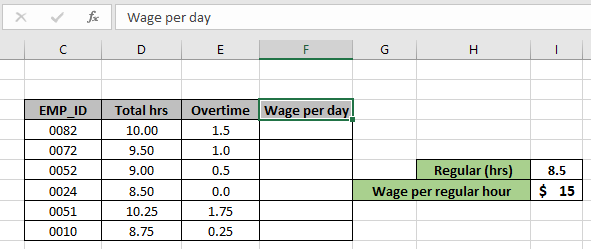

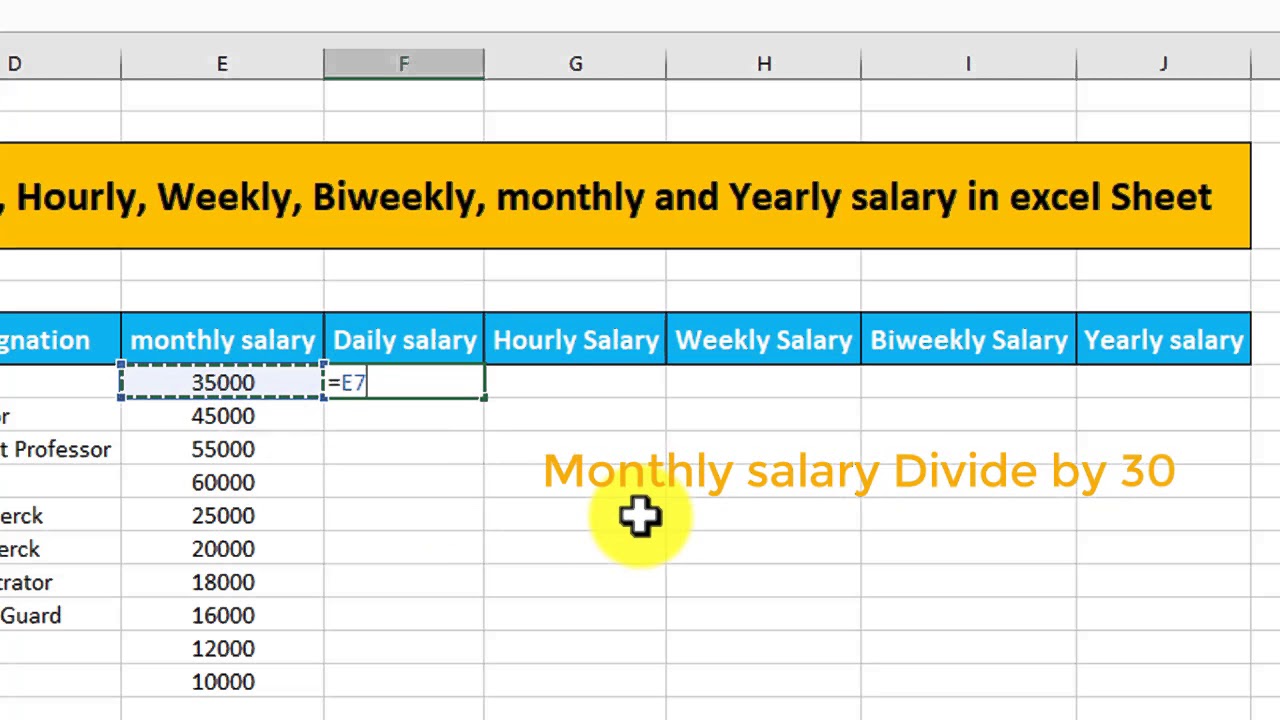

Hourly pay Monthly salary 12 Hours worked per week Weeks per year. Regular Weekly Pay Hourly Wage x Hours Worked. Then the calculation will be.

Therefore they will be equal to each other. Taxes Paid Filed - 100 Guarantee. In a few easy steps you can create your own paystubs and have them sent to your email.

30 2022 Floridas minimum wage will increase from 10 to 11 per hour. Total Pay per Period TP RP. Enter the number of hours you work each week excluding any overtime.

Overtime Weekly Pay Hourly Wage x 15 x Overtime Hours. Plus if you get paid on a salary basis but you are working more than 40 hours per week the calculator will even calculate what your hourly rate. Regular Pay per Period RP Regular Hourly Pay Rate Standard Work Week.

The overtime calculator uses the following formulae. While in case of the second tab called Hourly wage the equations used are-IF the hourly option is checked THEN. Total Salary Weekly Pay x Work Weeks per.

1200 90 1290 total pay due. Since the employee makes 10 an hour the employee should be paid 400 for the 40 hours worked and 150 for the extra 10 hours worked. Overtime Hours The amount of hours worked above-and-beyond 40 hours.

Ad Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Total Weekly Pay Regular Weekly Pay Overtime Weekly Pay. Hourly pay 2500 12 40 50 15 per hour.

Ad Create professional looking paystubs. Total pay per day 160 16 176. 1000154 1500 4 6000.

For example for 5 hours a month at time and a half enter 5 15. A workman earning up to 4500. Florida is one of the 25 states.

In this scenario you set the extra amount youll pay on top of the average hourly rate in dollars. Overtime Pay per Period OP OTR Overtime Hours per Pay Period. 30 x 15 45 overtime premium rate of pay.

As a Dollar Amount per Hour. 5 hours double time would be 5 2. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime.

For instance in case the hourly rate is 1000 and someone works 4 extra hours over the standard time of 8 hours a day his daily wage will be. Overtime 1 - This is the hour when overtime begins to be paid. -Overtime gross pay No.

Salary to Hourly Pay Calculator with Lost-Overtime-Wage Feature. Including the one-half times overtime multiplier the employee would be paid 550 for the week they. Note this is binded to the Regular period.

Enter the number of hours and the rate at which you will get paid. 45 x 2 overtime hours 90 overtime premium pay. Note this should be set to atleast one hour above Overtime 1 hour value.

A Hourly wage is the value the. Floridas hourly minimum wage is 10 an hour. This online Salary to Hourly Pay Calculator will translate your weekly monthly or annual salary into its per minute hourly daily weekly and monthly equivalents.

Of double hours Double rate per hour-Total gross pay Regular gross pay Overtime gross pay Double time gross pay. Payroll So Easy You Can Set It Up Run It Yourself. Of overtime hours Overtime rate per hour-Double time gross pay No.

EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Overtime Pay Rate OTR Regular Hourly Pay Rate Overtime Multiplier. 3000 dollars hourly including un-paid time is 6240000 dollars yearly including un-paid time.

There are two options in case you have two different overtime rates. Overtime 2 - This is the hour when the second overtime begins to be paidUse this when overtime is variable. Total pay for five days 176 5 880.

Overtime work is all work in excess of your normal hours of work excluding breaks. We use the most recent and accurate information. Lets say you earn 2500 per month and work 40 hours each week for 50 paid weeks per year.

The employees total pay due including the overtime premium for the workweek can be calculated as follows. To convert your hourly wage to its equivalent salary use our calculator below. 1000 8 8000.

If you worked 55 hours in a week your overtime hours would be 15. A non-workman earning up to 2600. This relates to 10400 per day 52000 per week at 40 work hours 225333 per month and 2704000 per year.

Calculate overtime pay for a monthly-rated employee. The final figure will be your hourly wage. Select the check box to enable the rate.

Overtime Pay Calculators

Overtime Calculator

Hourly To Salary What Is My Annual Income

Hourly To Salary Calculator Convert Your Wages Indeed Com

Calculate Overtime Amount Using Excel Formula

Overtime Pay Calculators

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Salary To Hourly Salary Converter Salary Hour Calculators

Hourly To Annual Salary Calculator How Much Do I Make A Year

4 Ways To Calculate Annual Salary Wikihow

How To Calculate Daily Hourly Weekly Biweekly And Yearly Salary In Excel Sheet Youtube

Overtime Calculator Workest

3 Ways To Calculate Your Hourly Rate Wikihow

Hourly To Salary Calculator

How To Calculate Payroll For Hourly Employees Sling

Overtime Pay Calculators

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator